The advent of GenAI has placed the finance and accounting sector on the brink of a transformational shift. This technology is poised to automate routine tasks, enhance data analysis, and improve decision-making processes.

But what exactly is GenAI, and how can it reshape your business? Our article delves into the intricacies of GenAI, showcasing its benefits and practical applications, from improving efficiency to offering real-time insights.

Finance and accounting are on the brink of a paradigm shift.

As generative artificial intelligence (GenAI) continues to embed itself into financial systems, the potential for long-lasting transformation is significant. From automating routine tasks to providing advanced data analysis and enhancing decision-making, GenAI is redefining how teams operate. In fact, for many leaders in this industry, that shift is already taking place — as organizations are already using embedded tools, like Sage Copilot, to automate time-consuming processes, deliver intelligent insights, and free finances teams from administrative burdens, allowing them to focus on strategy, leadership, and real-time decision-making.

With adoption growing, much of the momentum will come from software providers with strong, forward-looking AI strategies — emphasizing trust, security, and critical role of human judgment in navigating today’s fast-changing business environment.

The question is no longer whether GenAI will impact finance and accounting — but how you can make it work for your business.

What is GenAI?

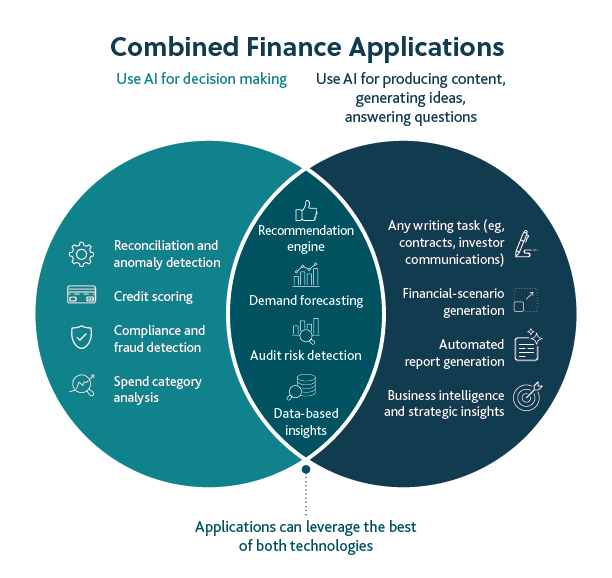

GenAI, a subset of artificial intelligence (AI), focuses on creating new content by learning from existing data. It identifies patterns, structures, and relationships within data, allowing it to generate new insights that mirror real-life financial trends.

This capability goes beyond simple automation. GenAI can uncover opportunities and risks that might otherwise go unnoticed, helping businesses to make more informed decisions.

In terms of finance and accounting, GenAI can help analyze data, forecast trends, and automate processes. So, this isn’t just about replacing manual tasks — although it does free up your finance team to focus on strategic initiatives, reduce errors, and improve efficiency.

For example, a mid-sized company using GenAI can automatically pull in and analyze financial data from various sources, forecast cashflow trends, and automate routine tasks like reconciling accounts and processing payroll. By leveraging GenAI and training the model, you reduce the risks involved with customizing other systems — like enterprise resource planning systems — while still providing that level of automation and experience.

This ensures accuracy while allowing finance teams to focus on higher-value work, like financial planning and risk management.

In short, it’s a gamechanger.

How can GenAI benefit finance and accounting?

The digital transformation that occurs when you integrate GenAI into your finance and accounting processes brings with it a host of benefits that can fundamentally change how your business operates. But this transformation is about more than just automation — it’s about freeing finance teams from administrative burdens, improving decision-making, and shifting focus toward strategic leadership. It also supports the broader wave of digital tools that are reshaping the industry, like robotic process automation (RPA), by working alongside them to deliver even greater efficiency and insight.

For instance, organizations using solutions like Sage Copilot are automating payment runs, streamlining billing, and identifying anomalies live — saving significant time while improving financial accuracy and control. By removing manual bottlenecks and delivering actionable insights, GenAI is helping finance teams shift from transactional tasks to strategic leadership.

Here are some of the key advantages GenAI offers finance and accounting:

Improved sustainability, transparency, and regulatory compliance

Automation and AI tools help organizations meet their sustainability and transparency goals by reducing reliance on manual processes and paper-based reporting. Because GenAI learns from structured financial data, it can uncover inefficiencies, optimize resource allocation, and generate insights that might otherwise go unnoticed.

By training GenAI on compliance rules and evolving regulatory standards, businesses can proactively monitor for risks and automatically update records — supporting a real-time compliance environment. As seen with AI-powered carbon accounting tools, AI is also helping organizations tackle broader environmental reporting obligations by streamlining data collection and reporting across markets.

Enhanced efficiency and streamlined internal processes

GenAI’s automation capabilities results in meaningful improvements in organizational efficiency. By reducing the manual workload — like data entry, transaction processing, and report generation — finance teams can optimize their internal processes, leading to faster decision-making and a smoother flow of information.

These systems can also detect issues early by analyzing patterns and flagging inconsistencies in as-it-happens, helping your business to catch potential issues before they become major problems.

Data analysis and forecasting

GenAI continuously learns from historical and as-it-happens data to identify trends, detect anomalies, and predict outcomes. This helps businesses like yours make better-informed decisions about budgeting, investments, and cash flow management. Rather than relying on monthly or quarterly cycles, finance teams can move toward continuous accounting and instant strategic forecasting — a shift that’s transforming how financial leadership operates.

Real-time and accurate data

Access to up-to-the-minute financial data means your business can act faster, adjust strategies proactively, and stay agile in competitive markets. AI solutions designed for finance are helping teams respond to market changes in real-time, improving cash flow control and enabling a more dynamic view of business performance.

Ease of use and accessibility

Today’s GenAI tools are built with accessibility in mind, making powerful financial insights available to teams without requiring deep technical expertise. By presenting data in intuitive dashboards and providing natural language suggestions, GenAI platforms simplify analysis and support confident, informed decision-making across all levels of the business.

Customization and learning

GenAI platforms adapt over time, learning from your organization’s unique data patterns, transactions, and operational processes. This allows businesses to customize their AI models to meet evolving needs — ensuring that automation, insights, and compliance support continue to improve as the business grows.

How exactly can GenAI impact my business?

GenAI systems have practical applications across various sectors within finance and accounting, making them adaptable to the breadth of needs of your business. Here are a few examples of how GenAI can be applied across different industries:

Economic development: Your organization can leverage GenAI for divestment or investment strategies by analyzing historical trends and scenario planning to make informed decisions.

Non-profit and Indigenous organizations: If you work in these sectors, consider using GenAI for budget sharing and funding opportunities to make sure your resources are being allocated in the best way possible. These tools can analyze funding patterns so you can make the most of your budget and impact.

Internal audit functions: These systems, including generic ones like ChatGPT or Microsoft Copilot, are transforming audit processes. As GenAI excels at data analysis and supporting informed decision-making, it makes audit and assurance practices more accessible and more efficient.

GenAI is full of untapped potential — with use cases and benefits that haven’t yet been fully realized. In the meantime, its implementation into your systems requires careful consideration. Here are some potential challenges to keep in mind:

- Data privacy and security: As these systems have access to sensitive data, robust cyber security and regulatory compliance are essential.

- Errors and biases: These platforms can produce inaccurate or biased outputs, known as hallucinations. Human oversight can help catch these errors and biases.

- Lack of transparency: GenAI’s algorithms can make it hard to understand how decisions are made.

- Over-reliance on technology: Overly relying on AI could undermine human judgment, and human oversight is still essential for financial decision-making.

- Ethical considerations: The ethical use of GenAI involves managing data responsibly and fairness, as well as raising concerns about the impact of this technology on jobs within finance.

- Legal liability: Errors and biased outputs could lead to financial mistakes and legal liabilities.

- Ongoing maintenance and monitoring: GenAI systems need continuous updates and monitoring to remain effective.

How can I get started?

If your organization is looking to integrate GenAI into its financial systems, here are some key steps to help set yourself up for success.

Ensure data accuracy

Clean, reliable data is the foundation of effective GenAI systems. Prioritize organizing your financial data so for better insights.

Understand the value of automation

Identify how GenAI can enhance automation and optimize your operations. This involves developing a comprehensive understanding of which financial processes will benefit the most from AI-driven assistance.

Prioritize data privacy and security

Implement strong cyber security measures to protect your sensitive information and ensure your compliance with regulatory requirements. Ongoing integrity health and risk assessments are important to keeping your data safe and secure.

Partner with the right providers

A major driver of GenAI’s success in finance and accounting will be software providers that embed AI capabilities into their platforms. Aligning with vendors with a clear and responsible AI roadmap can help your organization access built-in functionality, accelerate implementation, and scale your capabilities more effectively.

Collaborate with an experienced advisor

These systems can be difficult to implement alone. Working with a knowledgeable advisor can help you navigate integration challenges, tailor solutions to your unique needs, and maximize the value of your investment.

Ongoing maintenance and monitoring

These systems aren’t a one-time solution, they require continuous monitoring and updates to keep up with regulatory changes and evolving business needs.

Stay ahead with GenAI

The integration of GenAI into finance and accounting is more than a technology upgrade — it is set to be the future baseline of innovation. The organizations that embrace this change could gain meaningful competitive advantage, while those that don’t risk lagging behind. And as the world of finance and accounting continues to progress, staying ahead of the curve is vital.

By understanding the benefits, addressing the challenges, and taking proactive steps to integrate GenAI, your business can unlock a whole new level of efficiency, accuracy, and strategic insight.

Discover how GenAI can work for your finance and accounting team

You don’t have to execute this transformation alone — our advisors are here to provide you with the guidance and support you need to successfully integrate these tools into your financial systems.

Interested in learning more? We’re here to show you how GenAI can directly impact your organization and what your next steps should be. Let’s talk today.

Connect with us to get started

Our team of dedicated professionals can help you determine which options are best for you and how adopting these kinds of solutions could transform the way your organization works. For more information, and for extra support along the way, contact our team.