ESG strategies may not be mandatory yet, but the time is now to get ready, get disciplined, and take the first step towards developing your own.

Environmental, Social, and Governance (ESG) strategies have become increasingly prevalent and important for organizations to implement.

What sets a good ESG strategy apart from the rest is the data used to develop it. Without consistent data reporting and transparency, many ESG strategies will fail before they make it to implementation.

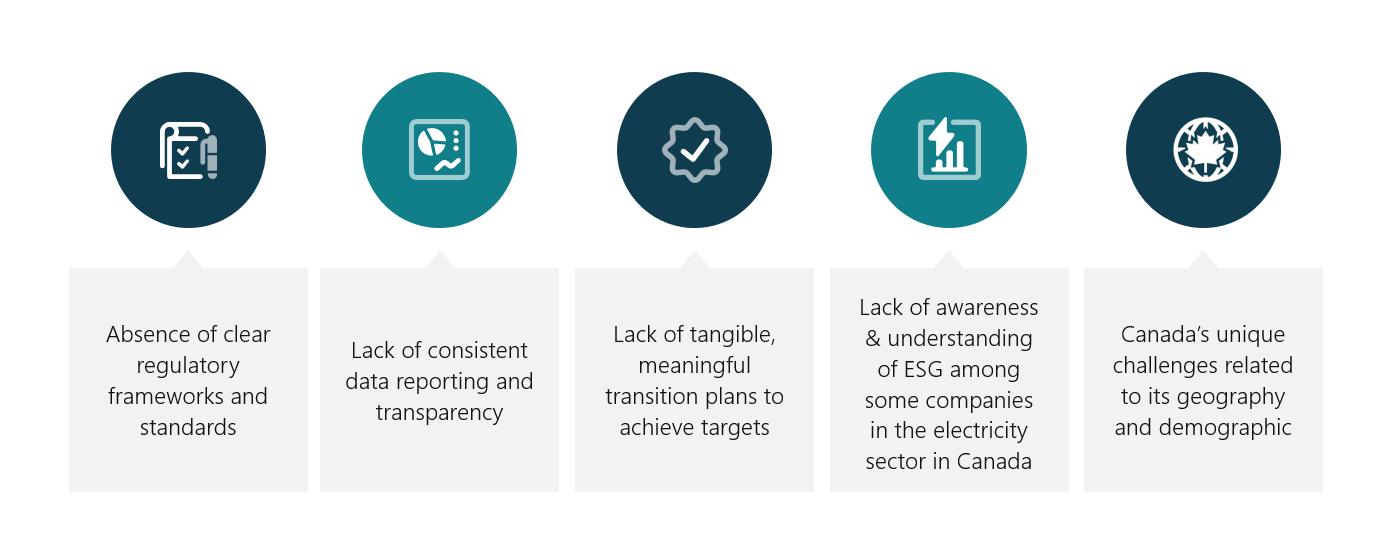

Within the energy sector, ESG looks at a company’s carbon footprint, responsible investing, water and biodiversity management, Diversity, Equity, and Inclusion (DE&I) practices, among many other factors, and a company’s goals are key in helping gather the data needed to develop these strategies. Today’s ESG landscape in Canada poses several varied challenges:

Implementing ESG policies requires a structured approach and thoughtful data strategy. But where do you start? Looking at what will drive your ESG strategy to work backwards from can help examine the overall goals of the strategy and how to keep is evolving.

You might also be interested in:

ESG drivers

ESG is not just a nice-to-have set of policies. It should be the story that drives the organization towards its goals and sets it apart from competitors to regulators. Beyond that, the story is what drives your overall goals and leveraging and balancing the needs of stakeholders with future-focussed business strategies is just part of that.

If you know your drivers, and have a firm grasp on your story, you’ll be able to better understand your audience and what they are looking for, which will push the story of your ESG strategy forward.

ESG encompasses various factors that can have significant implications for an organization. Identifying and prioritising these drivers is essential to effectively address them.

A company’s stakeholders, such as their customers, investors, and the communities they serve, often have specific expectations regarding ESG strategies. By understanding these drivers and balancing the priorities, an organization can create a comprehensive approach that aligns with industry-defying topics like cyber security, DE&I, and environmental impact.

ESG is all about risk and opportunity and if you approach developing an ESG strategy from a compliance point of view, the opportunities that exist might be lost. Going beyond compliance drives value and reputation as a leader in the industry.

Internal and external drivers of ESG include:

- Government

- Supply chain

- Indigenous

- Employees

- Families/Students

- Communities

Data strategy and governance

ESG strategies and initiatives are rooted in data, making it vital to know what data you need, where you’re getting it from and how to disseminate, appropriately and effectively, what might be large data sets.

Data-drive decision making can make a world of difference when developing your ESG strategy and as such, a strong strategy implies solid data governance.

A data governance framework will allow you to manage all facets of the data needed in your ESG strategy from planning through implementation. A flexible framework that takes quality, useability, compliance, and security into account will enable you to evolve your data and actions as change requires.

How to get started

As every company is unique, so too is the approach to developing an ESG strategy. Having a firm grasp of operational strategy and desired outcomes are vital at the beginning and throughout the process.

Through an ESG assessment, an advisor can help you assess what is currently in place (including drivers, data strategy and governance, etc.), where you need to go, where are the gaps, and what to do to fill those gaps.

Data analytics lead to ESG transformation, but not enough organizations are prepared to take the steps needed to begin creating a strategy.

Here are a few things that will need to be done at the start of the ESG development journey:

- Start by identifying KPIs – Are you planning on becoming carbon neutral?

- Data quality and data trust – Where is your data coming from and is it of sufficient quality for the purposes you need it for? What does the data governance structure look like within your organization?

- Implementation requirements – Bring everything together in a dashboard so that the data can be easily and consistently monitored to measure successes and failures.

Implementation

When it comes to successful adoption of an ESG strategy, there are things outside of data and drivers assessment that will need to come together.

Executive sponsorship is a big piece of that puzzle. Buy-in from the highest levels of the organization are key to its success and executives willing to invest in implementing ESG will be able to see the value the strategy adds firsthand and will continue to advocate for it in the future.

Good research and development are also important aspects to implementation. Set small goals to begin with but ensure that they go deep enough to utilize high quality and trustworthy data.

When implementing any new policy or strategy, there needs to be room for improvement. With an ESG strategy, be sure to leave room for failure. Start by going narrow and going deep. Deciding on one aspect of ESG to focus on and excel at can be powerful in scaling that to other areas of the business, and the ESG strategy, afterwards. Prepare to encounter challenges and learn from failure to be continually improving the strategy and the metrics by which its success is measured.

Ultimately, a successful ESG strategy starts with implementation and continues as the processes and policies are improved until a new standard is adopted across the organization, enough so that you’re able to see the value of the plan.

Here are some key steps to take and practices to have in place as an organization to ensure reputable reporting on ESG:

- A clear dashboard that demonstrates KPIs and KSMs that are aligned with environmental, social, and governance policies currently in place. This may include carbon reporting, DE&I practices, etc.

- High quality, recent data. Without the most up-to-date data from within your operations, an ESG strategy will never make it to completion.

- Be disciplined about integrating the data and putting together a report to help assess what the information means and what implications exist.

Challenges to building and implementing ESG strategies

Some of the challenges to developing an ESG strategy may be obvious; It will involve significant buy-in in terms of time and resource commitment from an organization to see it through. But the value it can add to a business’s operations and in helping reach strategic goals is also evident.

Here are some challenges to consider throughout the ESG strategy development and implementation process:

- Many utilities don’t have an existing dashboard so one will need to be created.

- Legacy technology and the structure it has created will likely need to be updated which can take time and resources.

- The data needed to develop a strategy might not all be in one place. This could make it cumbersome to gather everything you’ll need but there are benefits beyond ESG in this regard.

If you can address these challenges up front, even before starting to build your ESG strategy, you’ll be in a much better position.

Overall, organizations should recognize the significance of ESG, adopt a structured approach supported by high quality, trustworthy data, and prioritize the drivers of ESG throughout the process. It’s a journey, not a spring, and it will take time to get things right.

And by ensuring consistent data reporting and transparency, organizations can effectively communicate their ESG efforts and create value for stakeholders while mitigating risks.

Connect with us to get started

Our team of dedicated professionals can help you determine which options are best for you and how adopting these kinds of solutions could transform the way your organization works. For more information, and for extra support along the way, contact our team.