The benefits of scenario planning through advanced data modelling

The financial impact of COVID-19 has reached far beyond what anyone first predicted or expected. It seems as if overnight, stocks, portfolios, investments, savings, budgets and so forth became words with very little meaning or security. As a result, many Canadian businesses were forced to go into “crisis mode” as they had to determine the health of their current assets and income and make critical decisions in how they may be able to keep their doors open and their staff in operation.

During times of uncertainty, scenario planning becomes even more of an essential tool in reducing risks and taking advantage of opportunities. Research has shown that organizations that take a dynamic approach to a crisis benefit over those who do not. Businesses that remain flexible and implement detailed strategies tend to see shareholder returns almost double over the long term [1].

Traditionally, scenario planning has been based around the act of “pulling levers.” What do we mean by this? Individuals look at the options and tools they have in front of them while assessing the impact of high-level variables and pull levers, many times at random, to achieve their desired outcome. This process is used to develop “best” and “worst” case scenarios and help determine how a business should respond. Even when done more formally and with more significant analysis of the impacts of each lever brought into play, scenario planning can risk being hampered by the cognitive biases of those involved in the process. Background knowledge, personal assumptions and beliefs, fear of the outcome, and overconfidence in one’s abilities can skew results and reduce the effectiveness of the entire process [2].

Used effectively, scenario planning needs to:

- Be based on the most likely critical trends that will affect the business.

- Fully consider extreme eventualities to promote more creative thinking.

- Ensure that all voices are heard.

- Consider the implications of the various scenarios holistically across the organization.

- Be aligned with the organization’s “Purpose.”

However, one of the critical challenges in scenario planning is translating the hard work involved in coming up with potential implications and their financial impact. It’s not surprising that multiple, and particularly, more complex scenarios are not often considered. It becomes even more concerning when those tasked with being the stewards of the organization’s finances are forced to reject potential scenario approaches due to a lack of knowledge or experience to accurately measure potential costs and benefits.

Whether they are a small business or a growing and complex corporation with several financial streams that need to be accounted for, a more formalized and holistic scenario planning approach featuring cloud based Financial Planning & Analysis (FP&A) systems can be a benefit. Organizations can both enhance their decision-making with informed analytics and consider contingencies for greater risk mitigation.

Understand the complexities of Financial Planning and Analysis

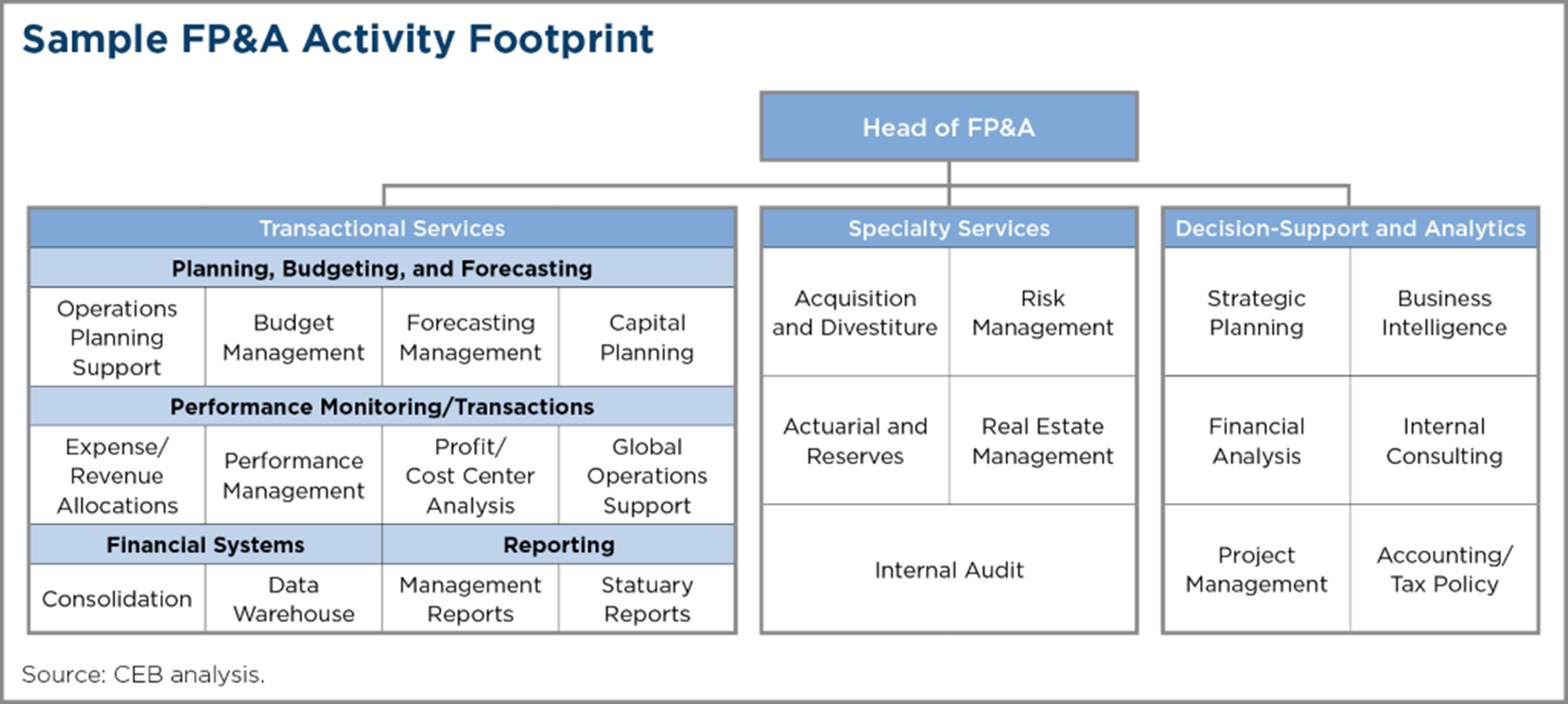

A Financial Planning and Analysis Activity Footprint indicates and helps visualize the varying considerations that must be accounted for in effectively crafting scenarios that address both risks and rewards. As noted previously, the individual assigned to creating and assessing the company’s financial risks based on key scenarios may be unable to do so without bias, the required information, or background knowledge in finance, market trends, prediction analysis, and so on. How is a business to effectively create both positive and negative scenarios and accurately develop critical points of action while doing away with a randomized lever approach? With access to tools designed for this very purpose.

Source: CEB Analysis (Large view)

Benefits of our digital finance solution

How is a business to stay up-to-date in the fast-changing world of business? Through implementing dynamic solutions and strategies. MNP will work with you to assess your financial needs and goals and help you develop strategies for scenarios that take into account every detail and the potential outcome. Our Digital Finance solution allows you to make the most of detailed and standardized reports while taking a simplified approach to financial management. A specially designed suite of tools allows teams to identify opportunities and benefits without becoming overwhelmed in acquiring the information they need through outdated technologies and systems.

Digital Finance solutions can assist your team in the following ways;

- Identify and measure performance gaps and areas of growth.

- Create clear objectives no matter the scenario and establish benchmarks to be met company-wide.

- Implement detailed processes and procedures based on key facts and statistics and evaluate and measure these processes’ performance.

- Assess overall performance and identify areas for further improvement.

- Measure each team’s successes and failures in meeting specific objectives and areas of improvement that must be considered and resolved.

MNP is in the business of helping businesses succeed. From the solutions we carry and execute on to the advice and expertise we bring to the table in helping you make the most of these solutions, we are here to help you navigate existing challenges and respond to unexpected situations that may arise.

Speak with an MNP advisor to explore how scenario planning can benefit your organization.

Connect with us to get started

Our team of dedicated professionals can help you understand what options are best for you and how adopting these kinds of technology could help transform the way your processes function. For more information, and for extra support along the way, contact our team.

Authors: Dan Caringi and Kevin Joy

Dan Caringi is a Partner with MNP’s Technology Solutions and Consulting teams in Mississauga. Dan brings 20 years of experience to help bridge the divide between technology and strategy. Delivering innovative solutions that address organizational challenges with practical results, he helps his clients move forward along their workplace transformation journey.

Kevin Joy is a Partner with MNP’s Consulting Services team in Montreal. Drawing on more than two-and-a-half decades of strategic marketing, business development and general management experience in Canada, the U.S. and Mexico, Kevin helps companies successfully navigate complex business challenges and thrive.